1. Introduction

The strict regulations on criteria pollutant and CO2 emissions established around the world will force humanity to stop using fossil fuels for transportation in the next years, despite being the best on-board energy sources in vehicles in terms of energy density and refueling time. In this sense, the established tailpipe CO2 limits will require a reduction of 3,4% per year in this decade in major markets. Concerning other pollutants, the current scenario shows that gas emission limits in the USA are the strictest in the world, while the European PN limits have driven a broader adoption of particulate filters, including for gasoline vehicles. Moreover, future regulations such as Euro 7 in Europe and LEV IV/Tier 4 in the USA will tighten the emissions targets focusing on further reductions in NOx and particulate limits, while also including new species and new procedures to emphasize the cold start contribution. With the adoption of the final Euro 6d regulations and on road testing requirements, modern Euro 6d vehicles are becoming more compliant with NOx emissions that are well below the laboratory limits even when tested on road [1]. In spite of this, several countries have announced targets for eliminating the internal combustion engine (ICE) by 2025–2040. For this reason, current research is focusing on developing alternative technologies that address the tank-to-wheel CO2 targets and the air quality concerns in city centers. Electrification will play a key role to reach those targets, starting with the wide-spread adoption of hybrid electric vehicles (HEV) and then looking towards the zero tailpipe emissions vehicle (ZEV) concept, including battery electric vehicles (BEV) and fuel cell electric vehicles (FCEV). The sales trends in 2020 suggest that the global sales of BEVs may continue growing exponentially as the battery-pack cost reduces from the current $137/kWh and the charging infrastructure increases. With the current growth rate scenario, it is assumed that the 50% BEV adoption point will occur globally around 2040. This will be feasible as battery prices drop significantly in this time frame. The opportunity for increased market penetration of these technologies in the near term is greater for light-duty than for medium- and heavy-duty applications, due the prohibitive battery weight and size, which impact the payload and total cost of ownership. However, considering the evolution of the materials and cost of the batteries it is also expected that these technologies can reach the medium- and heavy-duty sectors in the next decades. At some BEV penetration ‘pushback’ may occur where even the most capable, affordable BEV cannot replace an ICE equivalent for numerous reasons detailed within this paper. The timing and adoption level at the point of pushback is not clear.

This emissions regulations context results in the need for accelerating the technology development to increase efficiencies and reduce the emissions from ICE and hybrid technologies. For this, artificial intelligence (AI) and machine learning (ML) techniques in engineering simulation and design software are increasingly being used. In the heavy-duty sector, the increase of the peak firing pressure, optimization of the fuel-air mixing and the air path, use of exhaust energy recovery, reduction of the friction through lubricants, use of new piston designs and improvement of the engine control have been found suitable strategies to allow breaking the 50% BTE barrier. Light-duty vehicle technologies tend to implement downsizing, boosting, exhaust-heat energy recovery and high compression ratio to increase efficiency and reduce the emissions. Moreover, the addition of hybridization in the light-duty sector has been proved to provide fuel economy gains of around 35% over urban-like driving cycles. This improved efficiency, combined with the new engine exhaust aftertreatment technologies have led to near-zero criteria pollutant emissions for the current vehicles, even during real driving emissions (RDE) tests.

2. Regulations

2.1. Greenhouse gas emission regulations

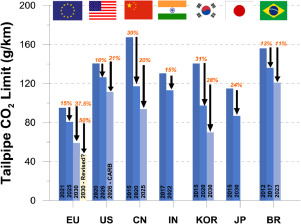

Road transportation globally accounts for roughly 15% of global CO2 emissions. About half of these emissions are attributed to the transportation of people via cars and buses [2]. This sector is under significant pressure to reduce greenhouse gas (GHG) emissions associated with fuel combustion, given the dire need to address climate change. Most major automotive markets have established tailpipe CO2 limits, and these are summarized in Fig. 1. While there are important differences in the measurement methods across these countries, broadly it is seen that meeting the requirements will require a reduction of 3 – 4% per year in this decade.

Fig. 1

Fig. 1Europe has set the most stringent targets for CO2 tailpipe emissions at less than 59 g/km in 2030, requiring a 37.5% reduction through this decade. There are discussions underway to further revise the target downwards to align it with the European Green Deal [3], which aims for net-zero greenhouse gas (GHG) emissions by 2050. These changes are expected to be published in the European Climate Law in June 2021 [4].

In the US, the Environmental Protection Agency (EPA) and the National Highway Traffic Safety Administration (NHTSA) issued the Safer Affordable Fuel-Efficient (SAFE) vehicles rule, which requires ~ 1.5% reductions in tailpipe CO2 emissions for model years 2021 through 2026 [5]. The targets are more stringent in the state of California, where OEMs have signed a voluntary agreement for 3.7% CO2 reductions year on year. As this article is being written, there has been a recent change in administration, and there are indications that the national standards will be reviewed and possibly made more stringent. Also, the rulemaking for post-2026 model years is expected to begin and result in further tightening of CO2 limits.

In China, passenger cars must meet fuel consumption reduction of 20% from 2021 to 2025, with average tailpipe CO2 at 95 g/km by 2025 on the New European Drive Cycle (NEDC). In the latest Technology Roadmap [6], China is targeting peak CO2 emissions from the transportation sector by 2028 and a subsequent 20% reduction in CO2 by 2035. By then, the market for new vehicles is expected to be evenly split amongst hybrids and battery electric vehicles.

2.2. Criteria pollutant emission regulations

Tailpipe limits on criteria pollutants – which include particulates, and gases such as oxides of nitrogen (NOx) and carbon monoxide (CO) – continue to be lowered across developed automotive markets. Fig. 2 shows the case for the US, where tailpipe standards are set for particulates and combined non-methane organic gases (NMOG) and NOx. It is seen that compared to model year 2000, gas and particulate emissions from modern light-duty vehicles will be required to reduce by ~ 90% and ~ 99%, respectively by 2025. Emissions are measured in the lab using a chassis dynamometer on test cycles such as the FTP-75 (Federal Test Procedure).

Fig. 2

Fig. 2Europe has also set increasingly stringent criteria pollutant standards, which have been adopted (with some important changes) by other countries such as China and India. NOx limits are set at 80 mg/km and 60 mg/km for diesel and gasoline passenger cars, respectively, and are measured on the WLTP (World harmonized light vehicles test procedure). Unlike the US, where particulate emissions are regulated on a mass basis alone, Europe has also set a particle number (PN) limit of 6 × 1011 #/km. To ensure compliance with the regulated limits under normal on-road driving conditions, vehicles are also required to be tested under real-world driving emission (RDE) conditions, in which the vehicle is driven for ~ 90–120 min on urban, rural and motorway routes. The total and urban emissions must meet the laboratory limits multiplied by a “conformity factor” (CF) which provides an allowance for measurement errors associated with portable emissions measurement systems (PEMS). The CF for NOx has been reduced from 2.1 to 1.43 and will be reduced to 1.0 starting in 2022. For PN, the CF is currently 1.5, although there has been a recommendation [7] to also lower this to 1.34 given the improvements in measurement capabilities. While a detailed discussion of emission after-treatment systems is beyond the scope of this paper, broadly it can be stated that the US gas emission limits are the tightest in the world and have driven advanced technologies for reducing NOx, while the European PN limits have driven a broader adoption of filters, including for gasoline vehicles.

Other major automotive markets such as China and India broadly follow either the European or US frameworks. The latest China 6b regulations which go into effect starting in 2023 are in some ways even tighter than Europe, with the gas limits set at roughly a factor of two lower compared to Euro 6.

Formal proposals on the next set of regulations are not yet published. However, discussions are ongoing and here are a few key elements being discussed for Euro 7:

-

•

Technology and fuel neutral standards, primarily eliminating the different NOx limits for diesel and gasoline engines, and extending the PN limit for all vehicles.

-

•

Further reduction in NOx and possibly PN limits. CO to also be limited on the RDE test.

-

•

PN limit to include sub-23 nm particles, likely down to 10 nm.

-

•

New species to be regulated, including aldehydes and ammonia, and methane and N2O to be accounted for as GHGs.

-

•

Modifying the RDE test to include a shorter urban driving distance and emphasize the cold start contribution.

The California Air Resources Board (CARB) held a workshop [8] to discuss potential changes to US criteria pollutant regulations as part of a LEV IV rulemaking. Some of the topics under consideration are:

-

•

Fleet averaged limits on NMOG + NOx emissions at 20 mg/mi (SULEV 20), a 33% reduction compared to the fleet averaged emissions in 2025, and with limits potentially applying to the non-ZEV portion of the fleet.

-

•

Further tightening of cold start emission requirements: Testing to include varying cold soak durations, and a reduction of the idling time in the FTP. A limit for high-powered cold start emissions from plug-in hybrids.

-

•

Tightening of the PM limit under US06 (aggressive driving) by a factor of two, to 3 mg/mi.

The timing on the next regulations in Europe and the US have not been announced but they will likely be implemented in the second half of this decade. The key takeaway from the above summary is that compliance with the future standards will ensure a significantly cleaner fleet, with tailpipe emission concentrations nearing, and at times even lower than, ambient levels.

2.3. Real-world performance vs. targets

To put the CO2 targets discussed earlier in perspective, it is useful to look at the past trends in improving vehicular CO2 emissions. Fig. 3 summarizes the significant reductions in fuel consumption achieved in the past couple of decades through improvements in both engines and vehicles. After years of lowering tailpipe CO2, it is seen that the improvements have stalled in the last few years. In 2019, CO2 emissions from passenger cars in Europe increased for the third consecutive year reaching 122.4 g/km (NEDC), an increase of 2 g/km compared to 2018 [9]. The auto industry is facing heavy fines for likely missing the 2021 target of 95 g/km. In the US, the average real-world CO2 emissions for new vehicles in 2019 increased by 3 g/mi to 356 g/mi compared to the previous year [10]. To ensure that the CO2 reductions are achieved in-use and not only during certification, new regulations in Europe require on-board monitoring of fuel consumption starting model year 2021.

Fig. 3

Fig. 3At least partly, the increase in CO2 emissions can be attributed to a growing consumer preference for larger (heavier) vehicles: only one third of new vehicles sold were sedans, while the rest were larger SUVs, pickup trucks and minivans. The market share of diesel cars in Europe has declined significantly from almost 50% in 2015 to < 30% in 2020 – again partly leading to this increase in CO2 emissions. Given the higher fuel economy of diesels (compared to gasoline vehicles), the reduced diesel sales makes the target even harder to achieve. It is evident that a significant uptake of advanced ICE technologies, hybridization and full electrification is imperative to meet the future limits.

Recent years have seen significant advances in both engines and after-treatment systems for meeting criteria pollutant standards [12]. Fig. 4 below shows two example studies which reported on-road NOx emissions from modern Euro 6 RDE compliant as well as older legacy fleet vehicles. The data highlights the poor performance of Euro 6b and older diesel vehicles which have been found to emit high NOx while meeting the standards under lab testing. On the other hand, it is seen that RDE norms have been successful in overcoming this limitation: modern Euro 6d compliant vehicles are emitting well below the laboratory limits even when tested on road. Gasoline vehicles are also well within the respective limits and have much better control of NOx emissions compared to diesels. Future regulations will likely address this gap through technology neutral limits.

Fig. 4

Fig. 42.4. ICE bans

In response to the need to reduce CO2 emissions, several countries have announced targets for eliminating the internal combustion engine, some of which are summarized in Table 1. There is a spread in the target dates: Norway is targeting the phase out of ICEs by 2025 while countries such as France, Spain and Canada are targeting 2040. The UK has announced a ban on pure ICE petrol and diesel vehicles starting 2030, and hybrids to follow in 2035. In the US, California's governor issued an executive order also targeting 100% sales of new light-duty vehicles in the state to be zero tailpipe emitting beyond 2035. States such as New York and New Jersey have pledged to also adopt the California targets, although there was no formal executive order issued. Note that the California decision is a target at the time this is being written, and details on the regulatory framework to enable such a transition should be forthcoming in the following years. According to the analysis done by the International Council on Clean Transportation (ICCT), the 17 governments which have announced ICE bans account for 13% of the global light-duty vehicle sales [15].

Table 1. Target bans on the ICE announced in various regions of the world.

| Target ICE ban | Region |

|---|---|

| 2025 | Norway |

| 2030 | UK: Pure ICE vehiclesIceland, Ireland, Israel, Netherlands, Sweden, Hainan (China) |

| 2035 | UK: HybridsCalifornia (US), Columbia |

| 2040 | Canada, Egypt, France, Spain, Sri Lanka, Taiwan |

3. Market analysis & forecasting

Global sales of passenger cars and light commercial vehicles have been declining since 2017. However due to COVID-19, a more substantial sales decrease of 14% from 83.7 million to 72 million vehicles occurred from 2019 to 2020 (Fig. 5). Unemployment rates rose to nearly 15% in the USA [16] while gross domestic product dropped by 25% from Q1 to Q2 in 2020 [17]. The drop in automotive sales is attributed to the weaker economy.

Fig. 5

Fig. 5Comparing quarterly sales figures between 2019 and 2020 highlighted the challenges caused by COVID-19 (Fig. 6). Sales in Quarter 1 (January–March) and Quarter 2 (April–June) dropped sharply. For example, the United Kingdom registered just 7905 vehicle sales in April 2020 compared to 185,000 over the same period in 2019. While this is primarily caused by economic factors, another barrier was global ‘lockdowns’ which prevented people from visiting dealerships. However, a strong recovery in Quarter 3 (July–September) and Quarter 4 (October–December) saw sales improve to 2011 levels. A strong recovery is predicted in the coming years with sales expected to reach a record high by 2024 [18].

Fig. 6

Fig. 6Global

Despite economic challenges associated with the pandemic and an overall decrease in vehicle sales, electrified vehicle sales and their market share increased compared to 2019 levels (Fig. 7). The global hybrid electric vehicle (HEV1) share increased to 3.2% of total sales compared to 2.8% in 2019. Plugin hybrid electric vehicle (PHEV) sales experienced the largest growth of any electrified segment with market share doubling from 0.6% to 1.2%. Battery electric vehicle (BEV) share grew from 1.8% to 2.8% representing 500,000 new sales. The increase in sales can be partly attributed to new models being introduced to the market. Key models introduced for 2020 and their sales volumes were the Porsche Taycan2 (17,700 units sold), the VW ID.3 (55,800), the Tesla Model Y (70,500) and the Wuling HongGuang Mini EV (127,000). These new vehicles accounted for over half of new BEV sales in 2020.

Fig. 7

Fig. 7EU-27

The EU-27 countries experienced significant electrified vehicle market share growth despite the pandemic. The market share of BEVs increased from 1.1% in 2019 to 3.6% in 2020 while the PHEV share increased from 0.6% to 3.4%. The HEV share also grew but only by 0.6% to end 2020 with a share of 2.7%. The share of plug-in vehicles (BEV & PHEV) was 7%, up from 1.7% in 2019. Overall nearly 10% of vehicles sold in EU-27 countries in 2020 were electrified compared to just 4% in 2019. Increasing incentive programs were largely responsible for the increase as well as gradual improvements in charging infrastructure, vehicle performance, and the availability of new models [19].

China

The Chinese light-duty automotive market saw steady growth in all electrified segments. The BEV share for 2020 was 4.3% which represents nearly 20% of total global BEV sales. Financial subsidies for 2020 new energy vehicles (NEV) were available in China based on battery size and charging speed, but these are now reducing each year and are set to expire in 2023 [20]. In many large Chinese cities, the purchase of a license plate for an ICE vehicle can take many months while a free and immediate license plate for EVs is guaranteed. This makes the electric vehicle an attractive proposition for those in cities [21]. Another contributor to increasing sales was from small, affordable BEVs which are well suited to the Chinese customer base. The purchase price of a BEV is often cited as the primary barrier to consumer purchase [22]. The low-priced Wuling Honggaung Mini EV sold well despite being just introduced in June 2020. The Wuling Honggaung Mini EV is available from CYN 27,000 (US $4160 equivalent) up to CYN 35,000 (US $5600). A 13.8 kWh battery provides 175 km range (NEDC). A 20 kWh motor provides a top speed of 100 km/h. The specifications and performance are well suited to city driving but are largely unsuitable for rural conditions. Whether this type of vehicle will result in significant long-term market share growth is still unknown.

USA

The USA has not warmed up to PHEV technology and sales volumes remain low at 0.5%, the same level as 2019. HEV sales increased slightly from 2.4 to 3.1%, attributed to two new truck segment HEVs introduced by the Fiat Chrysler Automobiles group (now Stellantis). The largest growth segment for hybrids was from large displacement V8 trucks, specifically the Dodge Ram eTorque in 2020. The trend of HEV increase will likely continue in 2021 as additional vehicles are brought to market [24]. In the USA it is likely that future hybridization will occur in the larger vehicle segments where vehicle price and profit margins are larger and fuel economy is relatively low. Larger vehicle segments (car SUV to Class 2A truck) made up over 60% of sales in the USA in 2020 [23].

BEV market share growth in the USA increased in 2020 in-line with global BEV increase to 1.8%. BEV sales growth stalled between 2018 and 2019 primarily because the two largest BEV manufacturers, GM and Tesla had reached their federal tax credit cap of 200,000 vehicles which removed the $7500 federal credit on offer [25]. However as new and legacy manufacturers bring BEVs to the market (e.g. Ford Mustang Mach-E) the federal tax credit is again available on these models. In 2021 in the USA alone, six new manufacturers propose releasing electric vehicles; Rivian, Lucid Motors, Lordstown Motors, Karma Automotive, and Bollinger Motors [26]. A further 12 new models from legacy manufacturers, in the USA alone, will likely lead to a further increase in BEV sales during 2021.

The market share of four other markets are also compared in Fig. 8. The market share of BEV sales in Norway rose again in 2020 from 33% to a final share of 44%. PHEV sales also increased from 11 to 17% while HEV sales dropped for the first time in five years from 10% to 7%. The successful BEV market penetration can be attributed to extreme incentive schemes put in place by the Norwegian government to encourage BEV sales [27]. In 2020 a 1.0 L TSFI gasoline-powered Volkswagen Golf cost the consumer more than a BEV e-Golf. The base price of the ICE golf is actually USD $11,000 less than the e-Golf, however taxes placed only on the ICE vehicle include: CO2, NOx, weight, and VAT (25%). The sum of these ICE-only taxes increases the price to around USD $800 more than the e-Golf [28]. It is unlikely that many other nations can follow Norway's aggressive incentive strategy and they will have to wait for technology-led cost reductions. Norway has set a target of 100% BEV sales by 2025 and by extrapolation of the previous three years can potentially meet this goal. A BEV market segment growth slow-down is possible before 2025 as lower income families may not have the means to transition to BEV transportation; a potential disruption to this expected trend would be further increases in incentives for BEVs.

Fig. 8

Fig. 8Japan leads the world in hybrid powertrain technology since the introduction of the Toyota Prius Hybrid in 1997. A significant portion of Japanese light-duty sales are hybrids, however during 2020 the market share for hybrids dropped from 22% to 20%. EV and PHEV market share also dropped during the same time giving Japan a unique trend of a falling electrified share in 2020. While traditional electrified vehicle market share fell in 2020, fuel-cell electric vehicle (FCEV) sales notably increased from 644 in 2019 to 717 in 2020. Despite this growth, absolute sales were insignificant compared to the 4,428,000 total sales in 2020.

The Indian market continued an increasing trend of electrification where hybrid share increased from 0.5% to 0.9%. BEV sales increased to over 1000 units for the first time but still represent an insignificant share of the market at less than 0.05%. In 2017, Transport Minister Nitin Gadkari announced that the Indian government had set a target for 100% BEV sales by 2030 [29]. That aim was quickly reduced to 30% [30]. Even the reduced target appears to be out of reach unless incentive schemes and affordable BEVs are rapidly adopted by consumers.

The UK, having departed from EU-27, has set a target for a total ban on the ICE by 2035 and a ban on non-hybrid powertrains by 2030 [31]. A large increase in electrified vehicle share was seen in 2020 where the UK finished the year with nearly 15% of the fleet with some level of plug-in or non-plug-in electrification, compared to 6% in 2019. The UK is expected to trend with EU-27 countries as it is following the same CO2 target pathway and so the increase in electrified share is required. The BEV share increased from 1.5% to 5.8%, while PHEV sales grew from 1.1% to 3.1%. The exponential growth rate is on track to meet the 2035 target however it is unlikely that exponential growth will be observed continuously for the next fourteen years. Observing future trends from Norway as they approach 100% may provide insight into whether the UK is poised to achieve this target.

The year-on-year global BEV share has been increasing since 2012 when Tesla introduced the Model S to the market. In 2020, nearly 2,000,000 BEVs were sold world-wide—a number that is expected to increase in the future. Electrified vehicle share has increased at a faster rate where 5,250,000 million were sold in 2020. However, the ICE is still a vital powertrain component with 70,000,000 vehicles sold in 2020 97.2% of the fleet. This value is down from 99.7% in 2015 and trends with exponential decay Fig. 9.

Fig. 9

Fig. 93.1. Forecast

The current exponential growth rate for BEVs and exponentially decreasing ICE share is expected to continue in the short-term. While absolute sales and market share will increase year-on-year, the growth-rate will reduce each year. In 2020 BEV growth was 40%, we predict this to decrease to 10% by 2040.

Vehicle cost, charging infrastructure, and “range anxiety” are cited as the biggest barriers to purchasing a full electric vehicle [22]. Range anxiety is a function of charging time and availability of charging stations rather than absolute range. Some high-cost, high-range BEVs are competitive with hybrid and ICE vehicles on absolute certified range. These barriers will reduce over time as battery-pack cost reduces [32] and charging infrastructure increases [[33], [34], [35]]. Technologies to reduce charging time are limited due to inherent challenges with lithium-ion technologies. These challenges mainly relate to thermal degradation at fast charging conditions. New battery chemistries or technologies (i.e. steady-state) may be required before charging rate increases exponentially in-line with other barriers mentioned above.

We propose several possible future scenarios for BEV adoption. The future scenarios follow a Sigmoid curve (or S-curve) where at some point there will be a slow-down in growth rate. The forecasted growth is based on two main factors:

-

1

Growth rate: continued improvement in technology and lower cost will naturally persuade people into purchasing BEVs. This scenario predicts that the rate of market share growth will continue at the current rate. A second scenario assumes an accelerated growth rate where either technology improves at a rate faster than present, there is a key technology breakthrough, incentive programs are increased, or outright bans force consumer choices.

-

2

Pushback: at some adoption levels there will be a percentage of the global population that will not commit to BEVs as they do not offer the same versatility as ICE equivalents. At some market-share there will be ‘pushback’ from these unique case groups that have needs which exceed the benefits from the growth rate factors mentioned above.

-

a

People who regularly drive their vehicle long-distances and require shorter recharging times. The longest-range BEV in production at the time of writing is a Tesla Model S Long Range Plus at an EPA-rated range of 402 miles [36]. A 40 min 120 kW supercharger event can recharge 322 of those miles (7.5 s per mile). Compare this to a Toyota Camry Hybrid range of 686 miles (EPA) from a 13.2 gallon tank which can be fully recharged in 100 s (0.2 s per mile) [37,38].

-

i

As discussed above, decreasing charging time will not continue along an exponential improvement curve without a technology breakthrough.

-

i

-

b

People who utilize their light-vehicle for regularly towing 6000 lbs. upwards. A reduced range due to towing impacts both BEV and non-BEV powertrains however the charging time factors mentioned above are amplified with BEVs.

-

c

People who wish to buy a large vehicle with an acceptable range at a low price i.e. competition to Ford Expedition, Chevrolet Suburban or Tahoe etc. The Tahoe has a cargo (all seats folded flat) interior space of 122.9 ft3 ($399/ft3) compared to the BEV Rivian R1S with a cargo space of 108 ft3 ($718/ft3). Although there is not yet a BEV competitor in the Suburban's class it is unlikely to beat the 144.7 ft3 ($357/ft3) that it offers.

-

a

The ’current growth rate’ scenario assumes 50% BEV adoption will occur globally around 2040 while the accelerated rate assumes 50% BEV adoption around 2032. The three separate ‘pushback’ scenarios are at 50%, 70% and 90% market share to give a total of six scenarios in Fig. 10. The situation in 2050 is unclear, as is the timeline for complete ICE vehicle phase-out. Based on the six different predicted scenarios, the BEV share in 2050 ranges from 67% to 99%. These scenarios highlight the need for continued research in all powertrain systems, including the internal combustion engine. The authors feel, that for faster reduction in GHG emissions, rapid movement towards a 100% electrified fleet should be an industry-wide target while simultaneously working towards further adoption of BEVs as technology, infrastructure and costs improve.

Fig. 10

Fig. 10Further forecasts have been made for two developed markets, EU-27 and the USA (Fig. 11). These predictions breakdown the powertrain by type to the year 2030. EU-27 countries are pushing towards aggressive CO2 targets and outright bans of ICE technology. Therefore, the growth rate of BEVs is expected to exceed the global rate of adoption. PHEV share will grow initially as an intermediate step towards BEVs, but then decrease as charging infrastructure and cost reduce for the full BEV. One country which may disrupt the PHEV trend is Germany where the unique operating conditions of the de-restricted autobahns may lead to buyers preferring PHEVs. Around half of the market will be made up by mild and full hybrid vehicles which will be required to meet the 30% reduction in CO2 by 2030 compared to 2021 [39]. The USA will initially follow a slow increase in all electrified powertrains due to the relaxed SAFE standards. However, it is likely that the fuel economy standards will be reviewed by the new administration which may impact standards before model year (MY) 2026. At this point the hybrid share will rapidly increase. Unlike EU-27, the PHEV share in the USA will increase owing to low gas prices and the requirement for larger, longer-range vehicles.

Fig. 11

Fig. 114. Internal combustion engine & hybrid technologies

2020, as noted elsewhere in this paper, has seen rapid changes in combustion engine and hybrid technologies. The 2020 COVID-19 pandemic had a substantial impact on the sector, with UK engine production falling by 27%, to give one example [40], and UK car production falling by nearly 30% [41]. This had a knock-on effect across the whole industry with more than 10,000 automotive industry jobs lost in the UK alone in 2020 [42].

Nevertheless, the challenges for industry far exceed those of the pandemic. Both environmental concerns and regulation are driving substantial reductions in both GHG and criteria pollutant emissions. As a result it remains clear that there continues to be a need for increasing efficiencies and reducing emissions from ICE and hybrid technologies [1]. Fortunately, as a paper published in this journal in 2020 found, there remains significant scope for continued improvements in these areas [43]. 2020 itself saw a number of advances in engines released as well as scientific developments around efficiency and emissions improvements.

Before we discuss engine technologies and emissions, one overriding theme at a number of automotive conferences and events in 2020 was the importance of simulation and the virtual world in engine design. Not least in a special issue of this journal [44]. Similarly there is clear evidence of the growing importance of artificial intelligence (AI) and machine learning (ML) techniques in engineering simulation and design software throughout the design space including in engine efficiency and emissions [45,46]. These approaches offer the ability to accelerate technology development, with optimization and near real-time feedback being possible with few physical experiments (which can be time consuming and expensive). Nevertheless, the market for good-quality experimental data to feed, inform, and validate these models and new tools will become ever more important as the emphasis on this virtual domain expands.

4.1. New engine announcements and research directions

Much of the headline improvements in engine efficiency came from the heavy duty (HD) sector. These include the announcement by Mack Trucks of a new version of their 13 L Mack MP8HE engine [47]. This engine has a 13% improved efficiency compared to its baseline “anthem” engine. This is achieved by exhaust energy recovery through a mechanical turbocompounding system where a turbine in the exhaust is linked through a transmission to the engine's crankshaft. The engine also features a “wave” piston design (which has previously been used in the heavy duty sector [48] and an increased compression ratio (17:1 to 18:1) for higher efficiency and lower emissions.

With an engine for a similar duty, Weichai announced the world's first 50% BTE high speed diesel engine [49]. This engine is a 13 L, 560 hp model, with a 2500 bar fuel injection system, and fully complies with the China VI and Euro VI emissions standards. This has been achieved by increasing peak firing pressure, optimizing fuel-air mixing and the air path, exhaust energy recovery, friction reduction through lubricants, and careful engine control. This is a notable achievement as previously efficiencies of this magnitude had only been seen in marine and other lower speed engines. Other HD engine manufacturers have demonstrated efficiencies >50% BTE including Volvo, PACCAR, and Cummins – and series production of these engines is close [50]. The DOE SuperTruck II program is targeting a 55% BTE engine in collaboration with four major US truck manufacturers [51].

Outside of the HD sector, another area of further development has been in downsized and boosted engines for light duty vehicles. Downsized (i.e. using a turbo- or super- charger to boost the inlet air pressure) engines have been in the market for longer than a decade, but nevertheless further improvements are being made to further increase their efficiency and reduce emissions. At the SAE WCX20 event, General Motors reported developments of what they describe as their “disruptive engine platform” [52]. The 3-cylinder (but 2-firing cylinders) 1.1 L engine uses a combination of downsizing and a high compression ratio (13.5:1). There is also a novel exhaust-heat energy recovery system where the two firing cylinders transfer their exhaust into a third, larger displacement cylinder, where the gas is further expanded for energy recover. The combustion is lean/dilute and hence a low(er) temperature type of combustion. All of these technologies are used together synergistically. GM reports increases in fuel economy by up to 38% compared to a naturally aspirated equivalent engine. This engine is not (yet) production ready but shows the direction of development.

Similarly, John Dec at Sandia National Laboratories has been working on a low-temperature combustion technique known as LTGC-AMFI to provide low emissions and high efficiency, reporting 45.5% BTE from a light-duty gasoline engine at the Thiesel 2020 conference. This potential and direction of development for SI engines is clear.

On a more scientific front, KTH and Wärtsilä have reported a detailed exergy analysis, with the aim of identifying the most important areas to improve engine efficiency, in a 350 L four-stroke marine engine [53]. The areas identified included combustion losses, heat dissipation (thermal) losses, and gas exchange (pumping) losses. By far the most important source of exergy losses was combustion irreversibility which was responsible for up to 2/3 of the total exergy destruction and is therefore a clear target for future work.

Hybridization continues to be an important avenue of development for SI engines, particularly for increased efficiency. At the 2020 SAE WCX20 event a paper from SwRI reported that a 1.0 L engine with as little as 5 kW of electric power can reduce the engine load by 3 bar BMEP. Ultimately through a technology termed “Hybrid Boost,” BTE can be increased by 2% through this technique, which provides better results at high engine load (so may suit pick-up trucks and SUVs). Overall, the paper reports fuel economy gains of around 35% over urban-like driving in the FTP75 cycle [54].

In a keynote talk at the Thiesel 2020 conference, Piotr Szymański of the JRC noted that while BEVs and PHEVs may account for up to 50% of new LDVs sold in Europe by 2030 and this may reduce oil dependency, it will increase the need for a variety of raw materials such as rare earth elements and cobalt that are needed to produce batteries. Minimizing the impact of this increased demand will require a different approach to recycling and the production, use, end-of-life cycle.

Emissions

The complexity of turbulent combustion as well as advances in propulsion technologies means that continuous advances are being made both in the understanding of emissions formation as well as control – particularly through engine exhaust aftertreatment.

Formation

The use of novel piston bowl shapes (such as steps) for soot (PM) emissions reduction in light duty diesel engines is well documented [55], however, Punch Torino have, in 2020, developed an additive manufacture designed piston that can provide PM reductions in the region of 30–80% (as well as a BSFC improvement of 2%), which Alberto Vassallo presented at THIESEL 2020. This is the first use, that the authors are aware of, of additive manufacturing being used to enable emissions reduction – but as additive manufacturing becomes cheaper and more mainstream, it is likely that this will not be the last!

At the ASME ICEF 2020 conference a number of papers reported on new developments in NOx emissions formation. Notably on using machine learning techniques to predict NOx [56], the effects of injector dribble on NOx [57], and NOx formation in natural gas engines [58]. SCR remains the dominant technology that is highly effective at NOx aftertreatment, nevertheless efforts to reduce the burden on aftertreatment as well as underpin the fundamental science behind NOx formation are welcome.

Another area of further research and interest has been that of sub-23 nm particulate emissions. While currently an unregulated emission, these are likely to become regulated in the EU with the introduction of the Euro 7 legislation. Studies discussing their formation, characterization, and filtration with gasoline particulate filters (GPFs) have been reported throughout 2020 [59], [60], [61], [62], [63]. While there are some challenges to the industry here, namely increases in reported tailpipe PN, particularly under certain conditions, the studies all report that the sub-23 nm particulates are controllable with existing GPF technology. It is therefore likely that all Euro 7 vehicles will have a GPF or equivalent technology.

Aftertreatment

Recent advances in engine exhaust aftertreatment technologies have led to near-zero criteria pollutant emissions from many vehicles. An increased focus in lifetime vehicle emissions, rather than just when purchased or certified, has been a focus in 2020. For example the US DoE Annual Merit Review [64] has stated as a target “90% conversion of criteria pollutants (NOx, CO, HCs) at 150°C for the full useful life of the vehicle.” To achieve this a number of areas are being explored in the aftertreatment space, notably thermal management (which is important not only for fast-warm-up and other RDE scenarios – see the next section, but also for catalyst lifetime performance). Similarly, SCR on DPF technologies are established in the heavy duty space and increasingly in the light duty space. Finally, catalyst aging remains an area with scope for further development, including both on-engine tests and rig-based testing such as with the Catagen test reactor [65].

SCR is well established as the dominant NOx control technology from engines that run lean of stoichiometric (notably diesel engines, but also a number of the high-efficiency technologies described in this paper). However, SCR typically requires active injection of an aqueous urea solution known as AdBlue or DEF. Systems are under development by Oak Ridge National Laboratories that would dispense with this requirement, and were this to become commonplace in the market, would transform the NOx aftertreatment market [66]. Given the potency of methane as a greenhouse gas, further development of methane slip catalysts is being maintained to remove impact of any methane emissions [67].

RDE

Real driving emissions (RDE), regulated in the EU since Euro 6d, continue to be an area of development. A number of recent reports have shown not only gasoline engines, but also Euro 6d diesel engine vehicles remain very clean [1,43]. Independent studies report that all regulated gaseous emissions and PM were well below the respective Euro 6 limits [68].

This is generally achieved on most vehicles with a variety of catalyst technologies, some close-coupled, others in the more traditional tailpipe locations. This enables good cold-start performance alongside good steady-state conversion. For example, this is the strategy employed by SwRI [69] in their near-zero emissions concept, alongside engine control and thermal management strategies integrated to achieve this [70].

In the medium- and heavy-duty space a similar technological approach has been employed [71]. Reports have also been released of RDE emissions from heavy duty vehicles such as in-service buses, which also reveal the importance of good thermal management [72]. New engine technologies have also reported low emissions levels such as the Achates opposed-piston 10.6 L diesel achieving 0.02 g/bhp-hr NOx with only a conventional diesel aftertreatment system utilizing a single SCR catalyst [73].

Looking ahead

There were a number of projects and announcements that will have impact well beyond the year 2020. Ricardo and Achates announced a partnership with ARPA-E funding for the further development of an opposed-piston gasoline compression ignition (OP GCI) engine intended for full-size pick-up trucks [74]. The Achates OP engine has been developed for a number of applications including stationary power generation, military, and truck engines.

Gasoline compression ignition remains a technology of interest. An EU Horizon 2020 project involving Shell, PSA and others reported a GCI concept that would run on standard EN228 RON 95 E5 gasoline [75]. This engine would require spark assist at low load, but otherwise demonstrated diesel-like efficiencies with a gasoline-fueled engine.

Running gasoline internal combustion engines very lean for high-efficiency remains a key technology going forward. Nissan (strictly in a 2021 announcement) announced a headline figure of >50% BTE for their new engine, which was achieved by running the engine in a dedicated hybrid mode and with exhaust gas energy recovery [76]. Nevertheless, by running the engine very lean λ>2.0 alone, they achieved a 46% BTE from that engine. At these air-fuel ratios, ignition of the pre-mixed, dilute air-fuel mixture is challenging, and technologies such as lasers, pre-chambers, and low-temperature plasma are under consideration to overcome the problems. So-called ultra-lean engines like these, alongside controlled end gas auto-ignition and gasoline compression ignition will be key future pathways to high efficiency.

Biofuels, which are derived from recent biomass, are a potential net-zero solution for the existing ICE fleet. Such fuels, predominantly ethanol in the gasoline market and a wider variety of fuels such as FAME in the diesel market, have been in consumers’ tanks for at least two decades. In the EU, E10 (increased from E5) is becoming more common in markets – approaching levels already seen in the USA. Nevertheless, sustainability concerns as well as indirect land use change impacts, mean that biofuels will never completely replace fossil fuels, and where they do it will be for high energy density applications such as marine and aviation.

There continues to be a lot of activity and interest in the area of e-fuels [77]. These fuels, also known as electrofuels and power-to-liquid fuels, can be made from CO2 and, if combined with renewable zero-carbon energy, can enable net-zero transportation from the existing ICE fleet. There has been a number of studies that focus on how to meet the EU CO2 reduction targets of 3.7 Gt CO2 between 2030 and 2050. Clearly BEVs will play a substantial role in this, but biofuels, e-fuels, and hydrogen might provide as much as one-third of the required CO2 reduction required [78]. Similarly, AVL calculated that 33 million tons of e-fuel per annum would be required to meet the 2 °C warming scenario, even with electrification [79].

The use of hydrogen, arguably the simplest e-fuel, is gaining interest in internal combustion engines, with some studies suggesting efficiencies from modern ICEs now approaching those of fuel-cells, and when existing infrastructure is taken into consideration there is significant interest in hydrogen internal combustion engines – H2-ICE. Notably AVL, an automotive consultancy, is developing a heavy-duty hydrogen internal combustion engine targeted at the truck market [80]. Activity is picking up rapidly in this area as the search for zero-tailpipe emission solutions suitable for all sectors continues.

Hydrogen need not simply be used on its own either. Because of its limited energy density and challenge to store on vehicles, certain sectors, notably marine, are pursuing ammonia (NH3), which has a much higher energy density, as a hydrogen carrier [81]. In 2020, Wärtsilä developed the first full-scale ammonia test engine [82] – and the research activity on ammonia as an energy vector and hydrogen carrier in the marine and energy-storage space is growing quickly.

5. Electric vehicle news

As previously described, 2020 was a year of growth for battery electric vehicles. 2.8% of new cars sold globally were BEVs, compared to 1.8% in 2019. Europe led the charge, with an increase in BEV sales from 1.1% in 2019 to 3.6% in 2020 (specifically in the EU-27).

The increased sales of BEVs can be attributed to a few factors. First, 2020 saw an expansion in the number of BEV models available. Couple this with improvements in range and reductions in battery cost, and BEVs are becoming an attractive option for more of the population.

Still, a limited range continues to be one of the main barriers to entry for battery electric vehicles. However, for around $70,000 you can now drive a Tesla Model S Long Range Plus with an EPA-estimated range of 402 miles. The longest range currently quoted for near-production vehicles (as far as we know) is from the Lucid Air Grand Touring edition, with a starting price of $131,500. It has a projected range of 517 miles (according to Lucid's website) but will not be available until the summer of 2021. The Lucid Air has a projected range of 406 miles and starts at $69,900. That version will not be available until “early 2022″. It will be interesting to see if future versions of this review paper include the Lucid models in the top spots for range. Until then, however, the Tesla Model S Long Range Plus holds the range crown.

Table 2 shows a summary of the ten BEVs with the longest range as of November 2020 [83]. A BEV's range is largely a function of its battery pack size, however there are many other factors that also affect range.

Table 2. Summary of the ten longest range BEVs available as of November 2020. Data from [83]. Note that the listed vehicle starting costs do not include any purchase incentives or credits.

| Car | Range (miles) | Battery Size (kWh) | Starting Cost ($) |

|---|---|---|---|

| Nissan Leaf S Plus | 226 | 62 | 38,200 |

| Polestar 2 | 233 | 78 | 59,900 |

| Kia Niro EV | 239 | 64 | 39,090 |

| Jaguar I-Pace | 246 | 90 | 70,875 |

| Hyundai Kona Electric | 258 | 64 | 37,190 |

| Chevrolet Bolt EV | 259 | 66 | 36,620 |

| Tesla Model Y Long Range | 326 | 75 | 48,490 |

| Tesla Model 3 Long Range | 322 | 75 | 45,490 |

| Tesla Model X Long Range Plus | 371 | 100 | 78,490 |

| Tesla Model S Long Range Plus | 402 | 100 | 67,920 |

As shown in Table 2, the Tesla Model S Long Range Plus was the BEV with the longest available range in 2020. It had an EPA estimated range of 402 miles and a starting price of around $70,000. Tesla actually held the top four spots, with the Long Range Model 3 coming in with the lowest starting price of around $45,000 for a 322 mile range. You can drop below the $40,000 mark with a Chevy Bolt, a Hyundai Kona Electric, a Kia Niro EV, or a Nissan Leaf S Plus, but with a trade-off in range of 225–260 miles per charge.

The evolution of the mean and median range of BEVs available in the USA from 2013 to 2020 is shown in Fig. 12. A consistent increase in range is shown.