While software runs on 100% of electric bikes (eBikes) on the market, very few riders know how big a role it plays in the overall user experience. People buy a Gamma bike for a gentle ride or a Bosch because it has more pep. While most of them think the difference has to do with the frame, motor or battery, it’s usually all in the code.

But developing software to power an eBike is a costly undertaking. Engineers have to understand the motor and the battery—and they have to know how to write a program that operates in a constrained environment and complies with safety standards. In such a fragmented market, no single manufacturer has enough sales volume to recover the development costs without charging a lot of extra money for software.

Two things are likely to change all of that soon. The first is that the market will undergo at least one big round of consolidation. Currently, over 10,000 companies offer eBikes, each with different components—and each providing a unique set of functions.

While many industry watchers expect consolidation to squeeze out most of the existing brands, most were surprised by the departure of Van Moof, the Dutch manufacturer with an innovative and popular eBike. The company recently went bankrupt after having burned through €200 million in venture capital.

Van Moof designed its own hardware and its own software, placing the most emphasis on the latter. It even pioneered the notion of a bike operating system—including diagnostics, antitheft systems and a subsystem to identify the cyclist. But with so many brands selling into the same market, like many other manufacturers, Van Moof couldn’t reach a high-enough sales volume to break even.

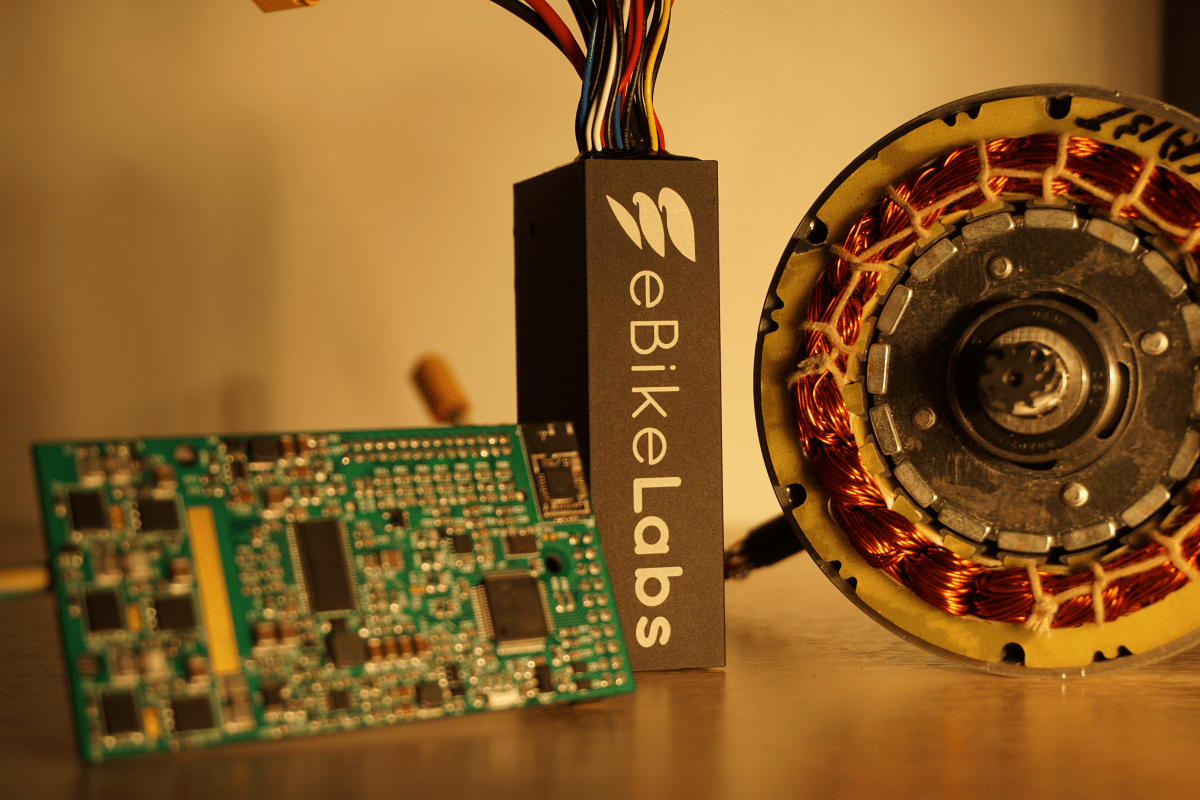

The second thing that will probably change the market is the emergence of standard software platforms. One startup that is staking its existence on this idea is eBikeLabs, the first player focused entirely on software for eBikes. The company has been in existence for eight years and now sells an operating system and software components that save manufacturers and independent application developers the trouble of having to write (and maintain) their own hardware-facing code.

What is software doing on a bike?

One thing software does is ensure a bike adheres to security standards, such as EN 15194, which was first published in 2017 to serve roughly the same purpose as standards for automobiles. Before EN 15194, companies could get away with low-cost controllers. But now the bar is higher, and vendors must deliver higher quality.

Maël Bosson, CEO and founder of eBikeLabs

eBikes

Maël Bosson, CEO and founder of eBikeLabs (Source: eBikeLabs)

eBikeLabs and many other companies are going beyond what is required by regulation. For example, EN 15194 requires a maximum delay for the motor to react in response to certain user actions—this is most often the time it takes for the motor to react when the user either starts pedaling or stops.

“The state-of-the-art in the market for the time it takes the motor to react when the user starts pedaling is around a half a second,” said Maël Bosson, CEO and founder of eBikeLabs. “Yet when we are in front of a computer, a half a second between when we move a mouse and when we see a change on the screen is unpleasant for the user. For this reason, eBikeLabs has greatly reduced this delay to make the system more interactive and intuitive. We’ve brought it down to 10 milliseconds.”

eBikeLabs also has features that allow the bike to adapt to the environment, such as the degree of incline, the weight of the rider and the wind speed. The company applied for a patent on its algorithm to have the bike immediately react to a change in incline, which Bosson said “completely changes the user’s perception of ease—and, consequently, the overall riding experience.” When the bike detects a slope, it compensates before the rider has time to feel a change in resistance.

Bosson draws from what he knows about user perception in front of a computer. (He did a Ph.D. on human-machine interaction.) Real time for a computer system that reacts with a user usually means that the computer reacts every 20 milliseconds. “It’s a little like the way film works,” he said. “If we want the system to be fluid, the system has to interact that quickly. For us, that means all operations have to be completed and commands sent to the motor within around 10 milliseconds.”

Two other categories of features provided by eBikeLabs are those associated with blocking the motor to prevent theft and those that help with regenerative breaking. Pedaling backwards activates the brakes, which helps recharge the battery.

On top of that, the embedded system generates data that can be used by a range of applications. For example, applications related to physical well-being might want to compute a pedaling profile for a given cyclist. Do they pedal a little more on the right side or on the left, for example? Other applications may want to collect infrastructure data—such as holes in the road—to help city planners. Still others may collect diagnostic data for bike maintenance.

eBikes

eBikeLabs

(Source: eBikeLabs)

The company is expecting a large market to evolve for a rich range of applications—including features nobody has yet dreamed of. “Our approach is to be something like the Android or Microsoft of the eBike world,” Bosson said. “The idea is to deliver a platform that operates on all existing bikes to give the market much-needed standardization.”

How standards will improve the market

One company that believes standards will drive down the price is Helbako. It has recently decided to apply the core strengths it has developed selling electronics for cars to the eBike market.

Ulf Zimmermann, managing director at Helbako

Ulf Zimmermann, managing director at Helbako (Source: Helbako)

Helbako has been delivering electronics for cars ever since it was founded in 1977. “We started with the central locking system,” said Ulf Zimmermann, managing director at Helbako. “If you just open or close one door, all the doors will automatically do the same. At the time, a system designed for positive user experience was a novel idea. But today, it would be hard to find a car without that feature. This is a good example of how computer technology came into automotive.

“People are willing to pay a lot for an eBike with comfortable features—and quality is important,” he added. “These two facts make the eBike an interesting market for Helbako. On top of that, the total volume of sales is already pretty high—5 million bikes are sold per year in Europe.”

Helbako has recently begun partnering with eBikeLabs. “We see a big market for applications on top of a platform,” Zimmermann said. “The market will enter an experimental era, during which new ideas will be tested. Do we need an automatic locking system combined with an iPhone or a Samsung? Should some manufacturers focus on luxury bikes for older customers, while others deliver crazier bikes for younger people?”

Over time, the demand side of the market will answer these questions. As for how the supply side meets the needs, surely it will come down to software.